Advanced Logic Analytics (ALA) is pleased to announce the release of its core big data analytics platform, ‘ALA OneLogic’.

ALA OneLogic was been developed to provide advanced big data analytics capabilities for financial markets firms requiring powerful mining, processing, managing and analysis of their enterprise-wide information assets and external data sources, in one optimised platform.

Commenting, Nick Ellis, managing director at ALA said: “Big data is complex and in itself it does not create value.” “Firms that are able to become masters of data through sophisticated analytics will be able to draw unlimited benefits, including enhanced strategic decision making, innovation, regulatory compliance, higher returns on investment styles, and increased operational efficiency,” he continued.

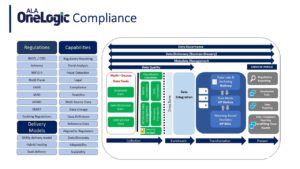

ALA OneLogic offers:

Big Data Analytics: Deployed as a primary source of business innovation, the advanced big data analytics capabilities of ALA OneLogic allow financial firms to conduct sophisticated data analysis, across business functions, at industry-leading scale and speed, regardless of where and how the data resides.

Firms can analyse, process and make sense of the ever-growing amounts of structured and unstructured data, in real-time, and can undertake pre-emptive, descriptive, and predictive edge analytics augmented with behavioural and emotional analytics.

Integrated with broad in-database applied machine-learning analytic capabilities and open source innovation, ALA OneLogic means firms can solve big data problems faster and at lower costs.

Compliance: ALA OneLogic offers deeper big data compliance analytics so firms can plan for, and successfully manage, evolving regulatory obligations. It captures all classifications of multi-jurisdictional regulatory data, performs analysis and generates reports using a single, integrated view across databases, files, applications, the cloud and the data lake.

Its unique analytics capabilities mean firms can quickly access all data types residing in enterprise repositories and gain conceptual and contextual intelligence. Firms can act on audits, respond to investigations, mitigate risk, minimise underlying operational costs and gain a clearer picture of its risk at any given time.

Commenting, Pim Dale, CEO of ALA said: “The volume of information required to collect in response to regulatory requirements has grown from hundreds of thousands, to millions of documents over the last few years.” “It is often the case that a regulatory investigation can hinge on identifying when a single piece of data was communicated, generated, altered or deleted, by and to whom and under what circumstances,” he continued.

ALA OneLogic is MiFIDII-prepared and ready to help financial firms address the regulation’s data-centric obligations.

Finance Analytics: Using best of breed algorithms, developed from over 10 years of academic research, ALA OneLogic offers a number of robust and sophisticated financial analytics models to help investors achieve higher returns across a spectrum of investment styles, including: Portfolio Construction, Sentiment Analysis, Mean-Variance and Stochastic Dominance, Asset and Liability Management, Robo-Advisor, and more.

-Ends-

About:

Advanced Logic Analytics is a provider of big data and finance analytics solutions. Those solutions facilitate better business insight and decision-making by leveraging enterprise-wide information assets and unlimited external data sources. The company’s core analytics platform, OneLogic, allows financial firms to analyse and process massive amounts of structured and unstructured data in real-time and undertakes pre-emptive, descriptive, and predictive edge analytics augmented with behavioural and emotional analytics.

Using the most advanced algorithms developed from over 10 years of academic research and connecting to any data source securely, OneLogic identifies and catches signs of bubbles, market trends, overconfidence in M&A deals, and other useful indicators, in any language, and across jurisdictions. ALA believes that business driven decisions should be firmly rooted in advanced analytics, not instinct.

OneLogic works with industry leading enterprise data frameworks, including Apache Hadoop and the HP Vertica Datawarehouse. For more information, visit: www.advancedlogicanalytics.com

Tina Snelling

Marketing Director