Generating Alpha

Financial firms implement a broad range of trading strategies in pursuit of alpha. They also develop their own statistical models and applications to help outperform the market. The OneLogic trading strategies suite adds complimentary services to an institutions own strategy.

ALATRA analyses a portfolio and then rebalances this to a new portfolio using advanced mathematical models that consider future uncertainties in asset return, interest rate, inflation and liabilities. In addition, our sentiment analysis provides daily trading signals, using real-time news and market data.

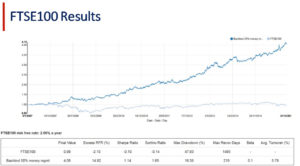

Testing and Validation

Once a firm’s trading strategy has been defined, it is then tested and validated.

Below are the results of three back-tests in which the asset universe was set to the respective constituents of three different equity indices. These back-tests covered the period 2007 – 2016 and the figures quoted show the over performance after trading costs.